Do You Really Need Accounting Software for MTD?

Tawhid Rahman

Founder & CEO, MTD Sheet

Share this post

In this article

Do You Really Need Accounting Software for MTD? The Honest Answer (2026 Guide)

With Making Tax Digital for Income Tax (MTD IT) becoming mandatory from April 2026, thousands of sole traders and landlords are asking

"Do I Need Accounting Software to Comply With MTD?"

The Honest Answer: No You Don't.

MTD's requirements are far simpler than most people realise, and HMRC does NOT force anyone to use full accounting software. This guide breaks down what HMRC actually expects, clears up common myths, and explains why Excel + bridging software (like MTD Sheets) is the most cost-effective solution for many taxpayers.

1. HMRC’s Actual Requirements for MTD Are Simple

To comply with MTD, HMRC only requires two things:

1. Digital Record Keeping

You can keep your records in any digital format, including:

- •Excel

- •Google Sheets

- •Any spreadsheet you already use

Spreadsheets are fully MTD-compliant.

2. MTD-Compatible Software to Submit Updates

You only need a tool that can send your figures to HMRC digitally.

This can be simple bridging software, not full accounting software.

There is no requirement to use cloud bookkeeping systems.

2. Why People Think They Need Accounting Software

There are several common myths that cause confusion:

Myth 1: You Must Keep Records Inside Accounting Software

False. Spreadsheets are acceptable.

Myth 2: Automation Is Mandatory

False. Automation is optional, not required.

Myth 3: HMRC Will Penalise You for Not Using Cloud Software

False. Penalties relate to late submissions, not your choice of software.

These myths lead many taxpayers to believe they need expensive tools — when they don’t.

3. Why Full Accounting Software Is Often More Than You Need

Many bookkeeping platforms require:

- •Monthly subscriptions

- •Long-term contracts

- •Onboarding and setup

- •Adapting to their workflow

And the cost adds up quickly.

It is common for subscription-based software to cost a few hundred pounds per year, even if you only need it for quarterly MTD updates.

Most small businesses simply do not need this level of software for MTD alone.

4. Why Bridging Software Is a Better Fit for MTD

Bridging software connects your spreadsheet directly to HMRC.

It allows you to:

- •Keep your existing records

- •Avoid data migration

- •Avoid system restrictions

- •Pay only when you submit

This makes bridging software ideal for taxpayers who want a cheap, simple and flexible MTD solution.

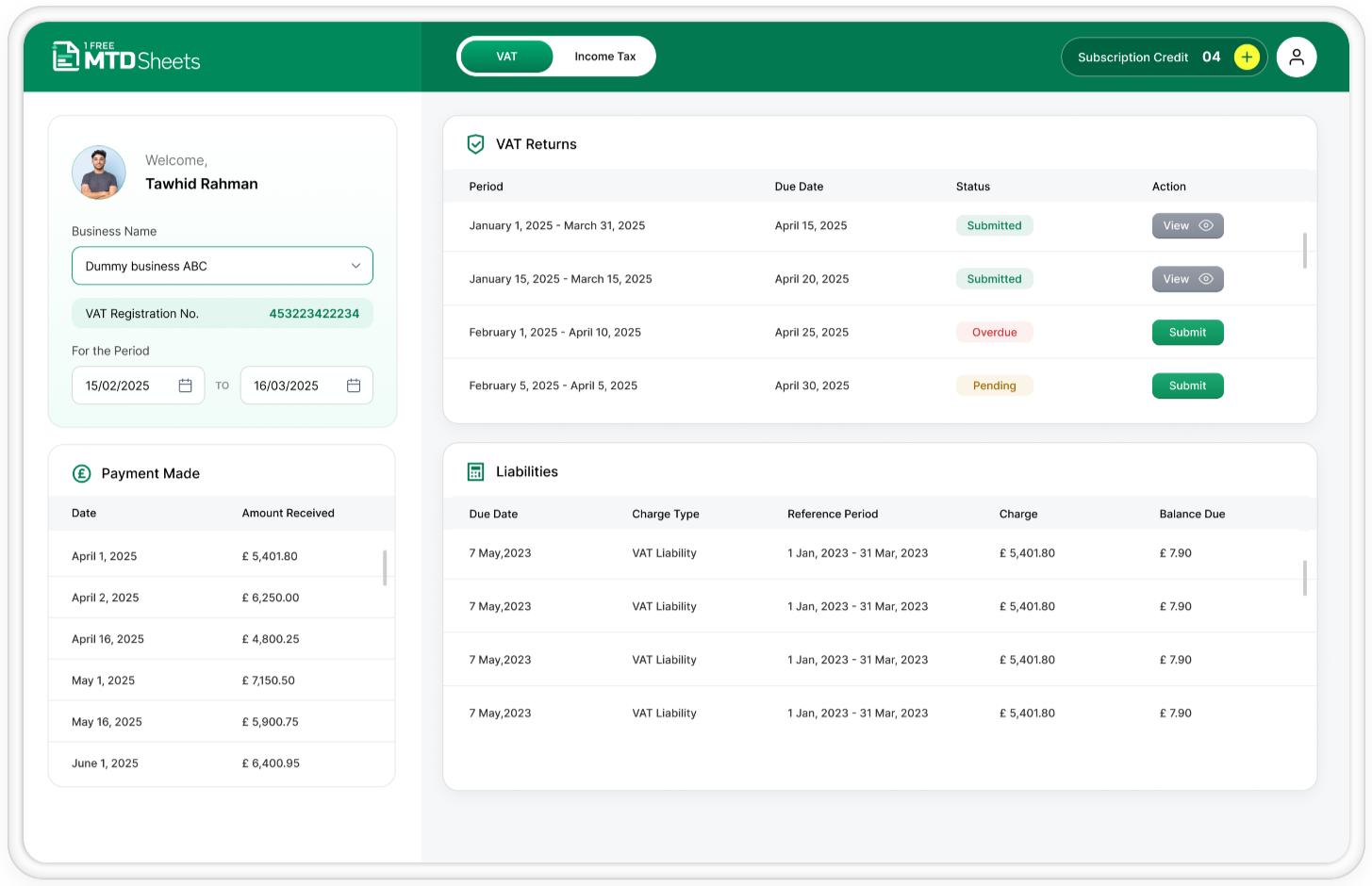

5. Why MTD Sheets Is the Preferred Choice

MTD Sheets offers:

Simple and Accurate Submissions

Designed by chartered accountants to ensure reliability.

Any Spreadsheet Layout Accepted

No templates or coding rules.

Works Perfectly With Bespoke VAT Calculations

Ideal for partial exemption, margin schemes and other complex VAT scenarios.

File From Mobile or Desktop

Quick, convenient submissions.

Optional Guest Submissions

No account needed unless you want one.

Extremely Low Cost Compared to Full Accounting Systems

You are not paying hundreds per year for features you do not use.

Final Verdict

No, You Do Not Need Accounting Software to Comply With MTD.

For most taxpayers, the best combination is:

Excel for Digital Records + MTD Sheets for HMRC Submissions.

It is simple, flexible and far more cost-effective than subscription software.

Don't miss these

Get in Touch